Page 20 - PA_Enterprise_September-2024

P. 20

PAE

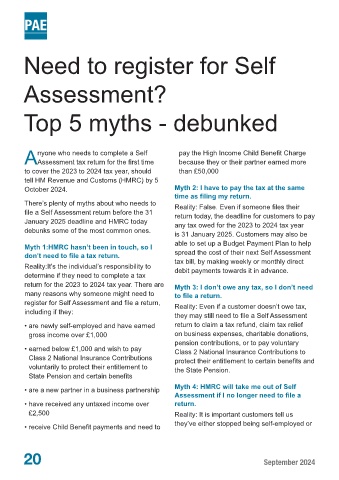

Need to register for Self

Assessment?

Top 5 myths - debunked

nyone who needs to complete a Self pay the High Income Child Benefit Charge

AAssessment tax return for the first time because they or their partner earned more

to cover the 2023 to 2024 tax year, should than £50,000

tell HM Revenue and Customs (HMRC) by 5

October 2024. Myth 2: I have to pay the tax at the same

time as filing my return.

There’s plenty of myths about who needs to Reality: False. Even if someone files their

file a Self Assessment return before the 31 return today, the deadline for customers to pay

January 2025 deadline and HMRC today any tax owed for the 2023 to 2024 tax year

debunks some of the most common ones.

is 31 January 2025. Customers may also be

Myth 1:HMRC hasn’t been in touch, so I able to set up a Budget Payment Plan to help

don’t need to file a tax return. spread the cost of their next Self Assessment

Reality:It’s the individual’s responsibility to tax bill, by making weekly or monthly direct

debit payments towards it in advance.

determine if they need to complete a tax

return for the 2023 to 2024 tax year. There are Myth 3: I don’t owe any tax, so I don’t need

many reasons why someone might need to to file a return.

register for Self Assessment and file a return, Reality: Even if a customer doesn’t owe tax,

including if they: they may still need to file a Self Assessment

• are newly self-employed and have earned return to claim a tax refund, claim tax relief

gross income over £1,000 on business expenses, charitable donations,

pension contributions, or to pay voluntary

• earned below £1,000 and wish to pay Class 2 National Insurance Contributions to

Class 2 National Insurance Contributions protect their entitlement to certain benefits and

voluntarily to protect their entitlement to the State Pension.

State Pension and certain benefits

• are a new partner in a business partnership Myth 4: HMRC will take me out of Self

Assessment if I no longer need to file a

• have received any untaxed income over return.

£2,500 Reality: It is important customers tell us

• receive Child Benefit payments and need to they’ve either stopped being self-employed or

20 September 2024